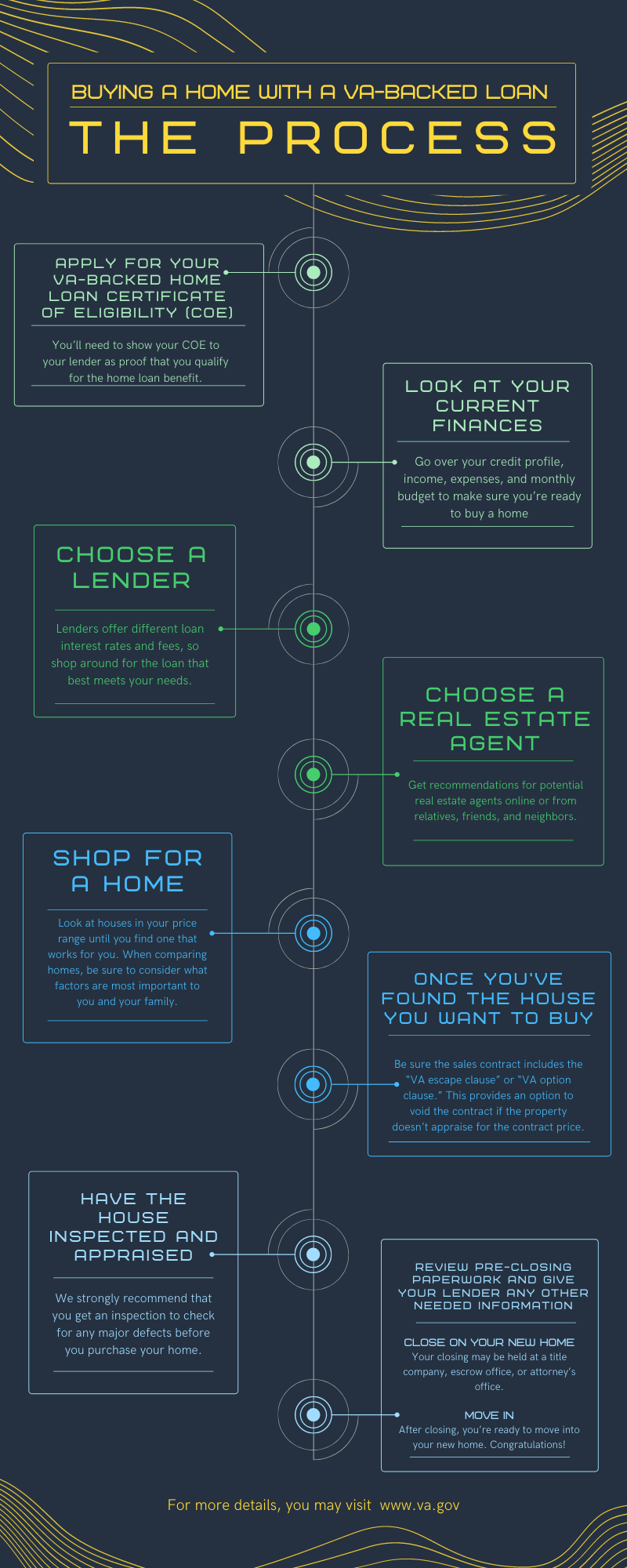

What is the process for Buying a home with a VA-backed loan?

What is the process for buying a home with a VA-backed loan?

Apply for your VA-backed home loan Certificate of Eligibility (COE)

You’ll need to show your COE to your lender as proof that you qualify for the home loan benefit.

Look at your current finances

Go over your credit profile, income, expenses, and monthly budget to make sure you’re ready to buy a home. Decide how much you want to spend on a mortgage—and be sure to include closing costs in the overall price.

Choose a lender

Remember, you’ll go through a private bank, mortgage company, or credit union—not through us—to get your loan. Lenders offer different loan interest rates and fees, so shop around for the loan that best meets your needs.

Be prepared to pay lender fees. Many lenders charge Veterans using VA-backed home loans a 1% flat fee (sometimes called a “loan origination fee”). Lenders may also charge you additional fees. If you don’t know what a fee is for, ask the lender. In some cases, lender fees are negotiable.

Choose a real estate agent

Get recommendations for potential real estate agents online or from relatives, friends, and neighbors. Then meet with several agents to find one you like.

Read all agreements before signing with an agent. Make sure you understand any charges, fees, and commissions as well as your rights and obligations in the buyer-agent relationship.

Shop for a home

Look at houses in your price range until you find one that works for you. When comparing homes, be sure to consider what factors are most important to you and your family. These may include factors like how far you’ll need to commute to work and the quality of local schools.

Steps to buying your home

Once you’ve found the house you want to buy:

Work with your agent to put together and sign a purchase agreement

Be sure the sales contract includes the “VA escape clause” or “VA option clause.” This provides an option to void the contract if the property doesn’t appraise for the contract price.

Ask your real estate agent for advice on other options for voiding the contract you may want to include, such as if the property fails a home inspection. These options are called contingencies.

Have the house inspected and appraised

We strongly recommend that you get an inspection to check for any major defects before you purchase your home. A VA-approved appraiser will also appraise the house to make sure it meets basic property condition requirements (called minimum property requirements, or MPRs), and will provide an opinion of value on the house. Please note that an appraisal isn’t the same as an inspection.

If the property doesn’t appraise at a value that’s high enough to get the loan, you have a few options. You can:

- Request a Reconsideration of Value (ROV). You can ask your real estate agent to provide the lender with valid sales data showing the property is worth more than its appraised price. The lender will ask the appraiser to reconsider based on this information.

- Renegotiate the sales price. Ask the seller to lower the price to match the appraised value.

- Pay the difference between the appraised price and the sales price. To do this, you’ll need to pay this cost at closing.

Review pre-closing paperwork and give your lender any other needed information

Your lender must give you a Closing Disclosure at least 3 business days before closing. Be sure to read it carefully. It includes loan terms, fees, closing costs, and your estimated monthly mortgage payments. Your lender may also ask you to provide more information or documents at this time.

Close on your new home

Your closing may be held at a title company, escrow office, or attorney’s office. Be prepared to sign a lot of documents—and be sure to take the time to read everything before you sign.

Move-in

After closing, you’re ready to move into your new home. Congratulations!

What if I need help or more information?

It time to call me, James at 561-318-0484 and start packing!